A Qualified Retirement Plan That Provides Most Individuals

An individual retirement account under section 408a or an individual retirement annuity under section 408b known as an IRA To determine whether your plan is a qualified plan most but not all plans are check with your employer or the plan administrator. A qualified retirement plan that provides most individuals with a deferred federal income tax benefit.

What Is A Qualified Retirement Plan A Resource Guide Retirement Planning How To Plan Saving For Retirement

The date on which the employee attains age.

. Types of Retirement Plans. Ad Open An Account That Fits Your Retirement Needs With Merrill Edge Self-Directed Investing. A Keogh plan is a tax-deferred pension plan available to self-employed individuals or unincorporated businesses for retirement purposes.

Voluntary employer-based retirement plans are governed by the Employee Retirement Income Security Act of 1974 ERISA. Our Free Quiz Helps You Find Compare Pick A Retirement Planner. Making contributions can lower your taxable income for the year potentially lowering your overall income tax rate.

However you need to understand the differences between the available plans. Most employer-sponsored plans are qualified retirement plans and these include 401k plans 403b plans SARSEP plans SEP-IRA plans and SIMPLE IRA plans. Individual Retirement Arrangements IRAs Roth IRAs.

A retirement plan helps to provide a dedicated measure of retirement savings which can ease employees financial anxiety now and create loyalty to the company. A qualified retirement plan that provides most individuals with a deferred federal income tax benefit. Examples of qualified retirement plans include 401k 403b and profit-share plans.

10 plans and ESOPs. 10 2022 1215 pm. Evaluate Funds and Performance Open an IRA Save for Retirement.

8 rows A 403b tax-sheltered annuity plan for employees of public schools or tax-exempt organizations. Qualified retirement plans must meet. Section 410 a 1 of the Internal Revenue Code Code sets forth the minimum age and service requirements for a qualified retirement plan.

A 401k is a type of qualified retirement plan as are pensions Keogh plans HR. Commission A method of paying an employee based on the number of sales the employee generates. In general a plan cannot require as a condition of participation that an employee complete a period of service with the employer extending beyond the later of.

For the most part these plans include employer-sponsored plans such as 401 ks 403 bs and Keogh HR. The accounting staff position that compiles and computes payroll data then prepares journalizes and posts payroll transactions. A 401k plan is a tax-advantaged plan that offers a way to save for retirement.

A qualified retirement plan is a retirement plan recognized by the IRS where investment. Common examples of qualified retirement plans include 401 ks 403 bs SEPs and SIMPLE IRAs. Ad Know Where You Stand and How to Move Toward Your Goals With Informed Confidence.

With both traditional and Roth options a 401k plan allows employees to put away money by. Ad Pick From Our Retirement Planner List. Employer responsibilities for.

Direct deposit The payment of an employees net pay using electronic funds transfer. Traditional IRAs while sharing many of the tax advantages of plans like 401 ks are not offered. SIMPLE 401 k Plans.

A qualified retirement plan is a specific type of retirement plan that confers tax advantages to employers and employees. With a traditional 401k an employee contributes to the plan with pre-tax wages meaning contributions are not. Official Site - Open A Merrill Edge Self-Directed Investing Account Today.

Qualified plans provide a tax incentive for businesses that contribute to their employees retirement savings. Ad Gain Clarity on How Much You Could Withdraw From Your Portfolio to Meet Your Income Needs. A qualified retirement plan that provides most individuals with a deferred federal income tax benefit Roth individual retirement account A qualified retirement plan that allows tax-free withdrawals from the account.

There are many similar plans that are not qualified retirement plans like IRAs Roth IRAs 403b plans and 457b plans. A qualified retirement plan that provides most individuals with a deferred federal income tax benefit. The total earnings paid to an employee after payroll taxes and other deductions.

A qualified retirement plan meets IRS requirements and offers certain tax benefits. A Quick Easy Planning Guidequot. Below well dig deeper into.

SIMPLE IRA Plans Savings Incentive Match Plans for Employees SEP Plans Simplified Employee Pension SARSEP Plans Salary Reduction Simplified Employee Pension. Ad Download the guide called When to Retire. A Keogh plan can be set up as either a defined-benefit or a.

A 401k is one of the most common qualified retirement plans. Qualified retirement plans meet all the stipulations laid out in the IRC to allow for tax-deferred contributions.

Retirement Retirement Money Savings And Investment Personal Savings

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

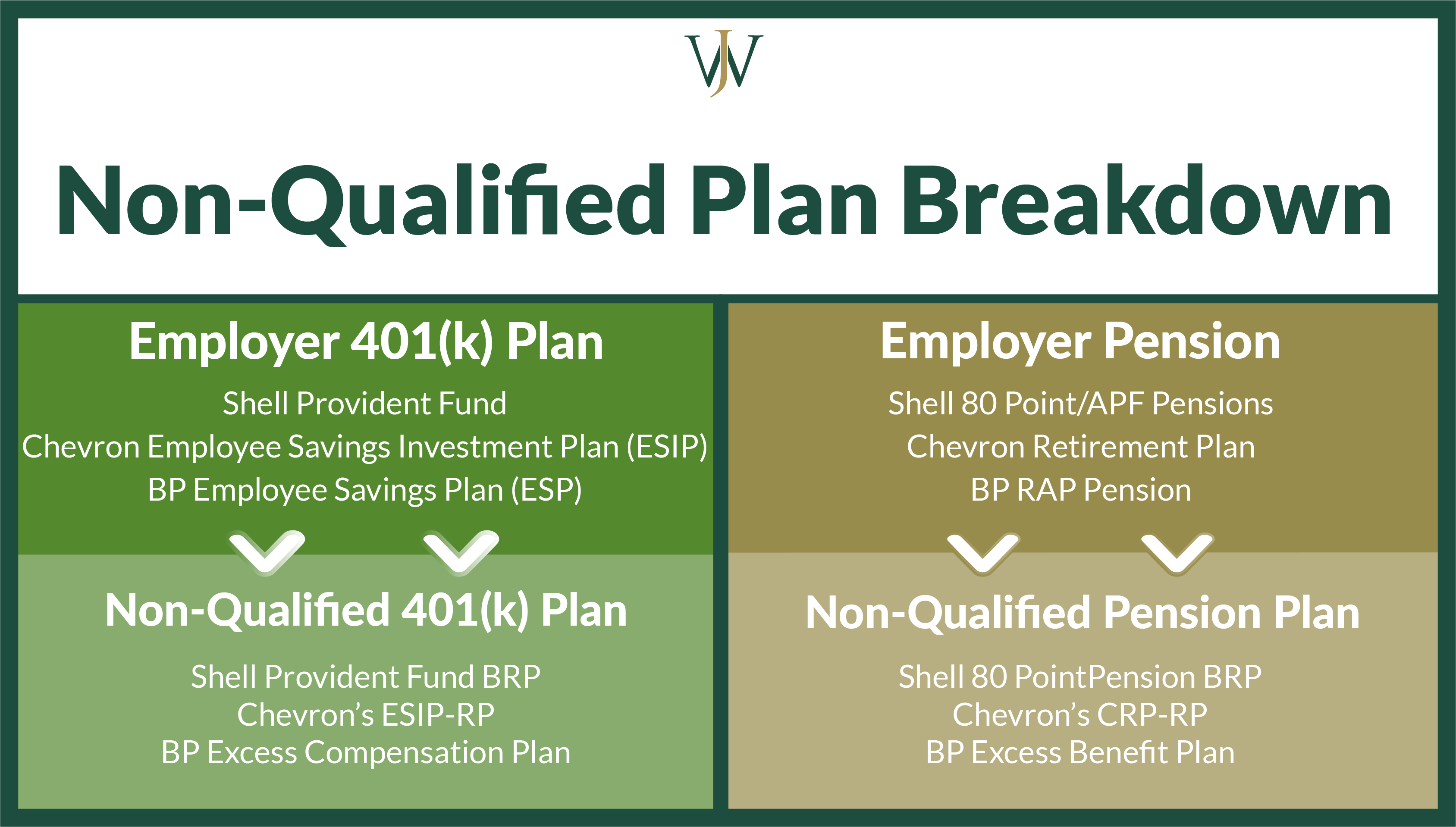

Tax Impacts Of Non Qualified 401 K Pension Benefits For High Income Earners

2019 Roth Ira Withdrawal Rules Infographic Inside Your Ira Roth Ira Withdrawal Roth Ira Investing

Guide To Taxable Income For Individuals How To Calculate Your Taxable Income Amount Estimated Tax Payments Income Federal Income Tax

Qualified Vs Non Qualified Annuities Taxation And Distribution

:max_bytes(150000):strip_icc()/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

No comments for "A Qualified Retirement Plan That Provides Most Individuals"

Post a Comment